Buffett’s Advice to Layman Investors: Keep It Simple and Keep It Cheap

13 March 2017

In Warren Buffett’s latest shareholder letter, he again let loose on the investment community, in particular high-fee active managers – especially hedge fund managers.

Of interest is his long running $1M bet made in 2007 with Ted Seides of Protege Partners, which invests in hedge funds. Buffett chose the Vanguard S&P 500 Index Fund and pitted it against a choice of Protege’s basket of hedge funds. That bet is set to complete by the end of 2017, and, to date, Buffett’s index fund is up 85% compared to Protege’s return of only 22%. With around 9 more months to go, it is unlikely that Mr Buffett will lose his $1M dollars, as he will need the S&P 500 to drop by more than 61% to lose to Protege. The S&P 500 has never dropped by that amount in a calendar year, if you check data going back to 1928; not even in the Great Depression of the 1930’s nor the recent 2008 financial crisis.

Mr Buffett has long been an opponent of the hedge fund industry, highlighting that they do not provide value to investors. At last year’s Berkshire shareholder’s meeting he stated: “there’s been far, far more money made by people in Wall Street through salesmanship abilities than through investment abilities.” Buffett also highlighted that one of the main reasons why he took up the bet was based on Nobel Laureate William Sharpe’s 1991 paper “The Arithmetic of Active Management“. Buffett noted that active investors on aggregate will fail to outperform the lower-cost passive investor due to costs:

“A lot of very smart people set out to do better than average in securities markets. Call them active investors. Their opposites, passive investors, will by definition do about average. In aggregate their positions will more or less approximate those of an index fund. Therefore, the balance of the universe—the active investors—must do about average as well. However, these investors will incur far greater costs. So, on balance, their aggregate results after these costs will be worse than those of passive investors.”

In Bill Sharpe’s paper, he noted that one of the reasons why costs are higher for the active manager is that they trade much more frequently – “An active investor is one who is not passive. His or her portfolio will differ from that of the passive managers at some or all times. Because active managers usually act on perceptions of mispricing, and because such misperceptions change relatively frequently, such managers tend to trade fairly frequently — hence the term “active.”

Buffett’s simple advice makes perfect sense. There have also been countering viewpoints, such as this one in Bloomberg View. Yes, Warren Buffett is an active investor, and one might ask why he does not follow his own advice and buy the S&P 500 index. But, don’t forget, Mr Buffett’s ability to hold stocks for 20-30 years is far longer than the average investor. The average investor will also be unable to buy stocks at the prices he can access, or do the deals or mergers and acquisitions which Buffett is capable of. The average investor will not have the courage to pick up stocks at the bottom of the bear market nor learn how to trim positions when the market is too frothy.

What about the hedge funds whose strategy is meant to be low volatility and attempt not to lose money for clients? Whilst in some cases the risk could be lower with certain types of hedge fund strategies, not all investors will understand how hedge funds work, not all investors will be able to access or buy these hedge funds due to high minimum investment amounts, and not all investors will be able to choose or pick the right one out of over 8,000 hedge funds in the world. With all these barriers to entry, the ordinary investor will be left in the lurch. As such, they would be best served in buying something diversified, simple and at a reasonable cost to ensure a favourable long-term outcome.

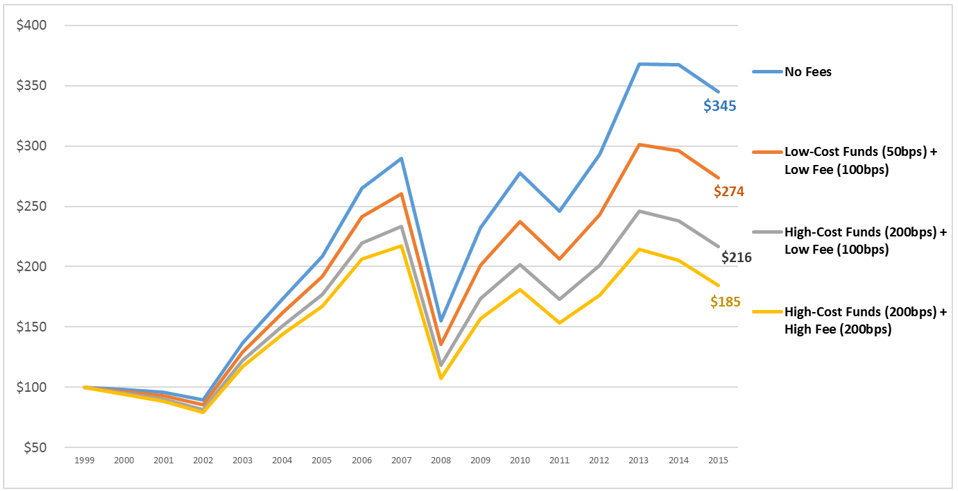

Our chart below shows the impact of costs over the long run. These calculations have been done on an actual globally diversified equity index. The best outcome is from No Fees, but unfortunately the index is uninvestible. The best outcome is thus for the investor to choose a low-cost fund option, and ensure that they are fairly charged by their advisor. The moment we venture into the higher cost arena, you can see how value is deducted – and typical active funds and hedge funds have a high-cost structure.

Source: GYC, Bloomberg

Using Mr Buffett’s statement as our closing paragraph, “The bottom line: When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds.”

We want to highlight one of our investment philosophies: Focus on What You Can Control. You cannot control what the market will give to you, but you can control simple things like cost, diversification and building a proper portfolio.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.