Home Sweet Home

08 August 2019

“Change is the very essence of life. The moment we cease to change, to be able to adapt, to adjust, to respond effectively to new situations, then we have begun to die.”

– Lee Kuan Yew

As our country prepares to celebrate its 54th birthday, it is appropriate to remember this sage quote from our founding father.

Many of us are resistant to change. It takes great effort and a mindset change to move ourselves out of our comfort zones. The same is also true when it comes to investing. We become comfortable with familiar, well-known household names and shy away from those we do not recognise.

Investors around the world typically suffer from home bias. They tend to over-concentrate their wealth in domestic assets – be it stocks, bonds, property or currency.

This creates a massive problem. Take, for example, a Singaporean investor:

- You have a job working for a company based in Singapore, and your salary is paid in Singapore dollars.

- Your expenses are primarily in Singapore dollars.

- The home you live in is paid for in Singapore dollars, and forms a large part of your overall assets.

- Your investment portfolio is primarily allocated to Singapore companies because you are familiar with their names. Those companies do a lot of business in Singapore.

- Your investment property is located in Singapore and forms another large chunk of your overall assets. Let’s not forget that mortgage as well – where the interest rates are controlled by the local SIBOR (Singapore Inter-Bank Offered Rate).

Do you see where we are going with this? In this scenario, almost your entire life and assets are focused on a single country. You are thus nearly 100% correlated with how the country does. When the economy tanks, you may get retrenched or reassigned. Your income is affected. The stock market does poorly, affecting your net worth. Property prices come down.

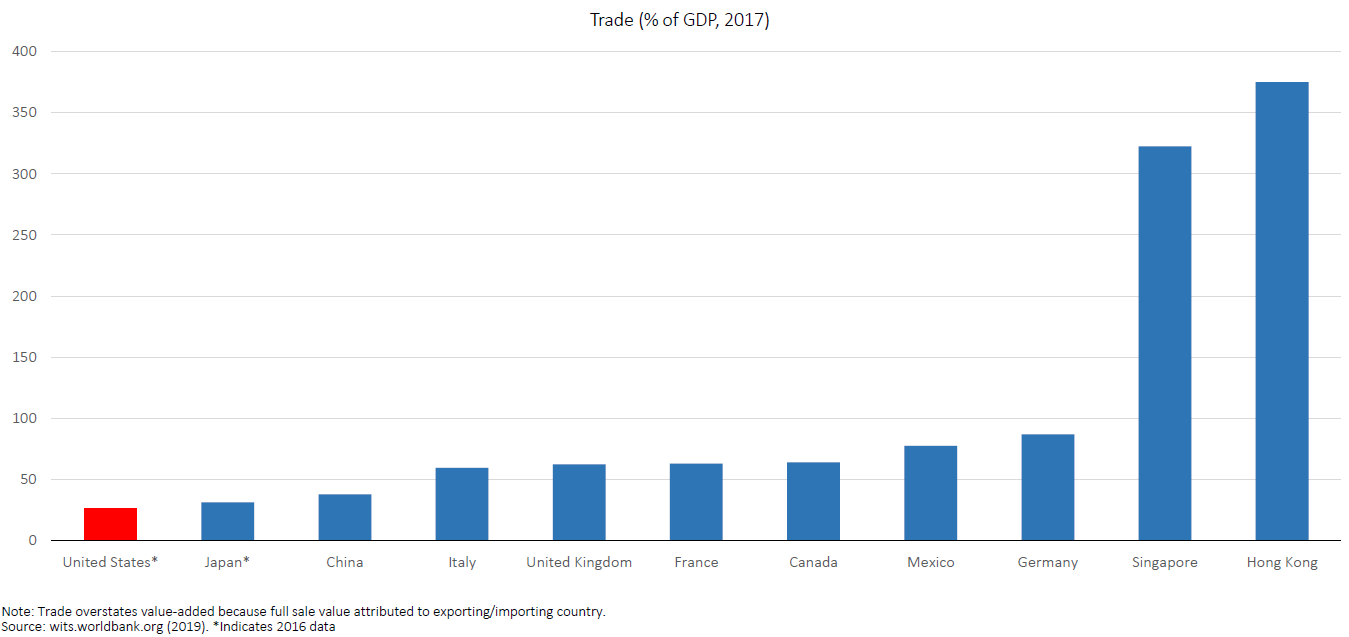

It makes sense not to put too much money in one place, especially when things become uncertain. The recent US-China trade war is a good example. Any disruption in global trade has an overwhelmingly large impact on the Singaporean economy. The chart below shows the local impact of trade – it’s over 300% of our GDP!

This is where diversification comes in. The simple idea behind it is that no two investments perform in exactly the same way at the same time. By mixing up assets in your portfolio, and diversifying geographically within those asset classes, you thus have a shock absorber in the down times.

Professor Ken French, who co-authored the seminal paper on asset pricing together with Nobel laureate Eugene Fama, highlights that diversification provides long-term certainty of return on investors’ portfolios. While it does not eliminate the volatility of the overall market, it protects against additional volatility (unsystematic risk) that arises from the characteristics of individual firms or asset classes.

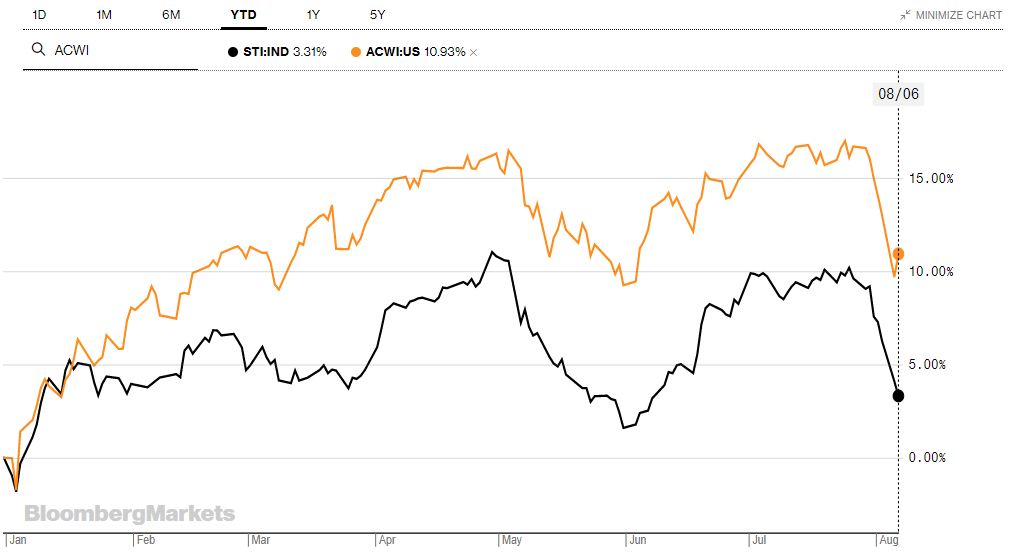

Broad diversification across and within asset classes becomes very important for investors during periods of high volatility. So far, we have had a topsy-turvy increase in tariffs on China, resumption of talks and then a sudden resumption of threats of more tariffs. The short-term chart below shows the big difference between the returns of the Singapore stock market and the global stock market for 2019. Despite the volatility, global stocks have come in at just over 10%, with the Singapore markets at just over 3%.

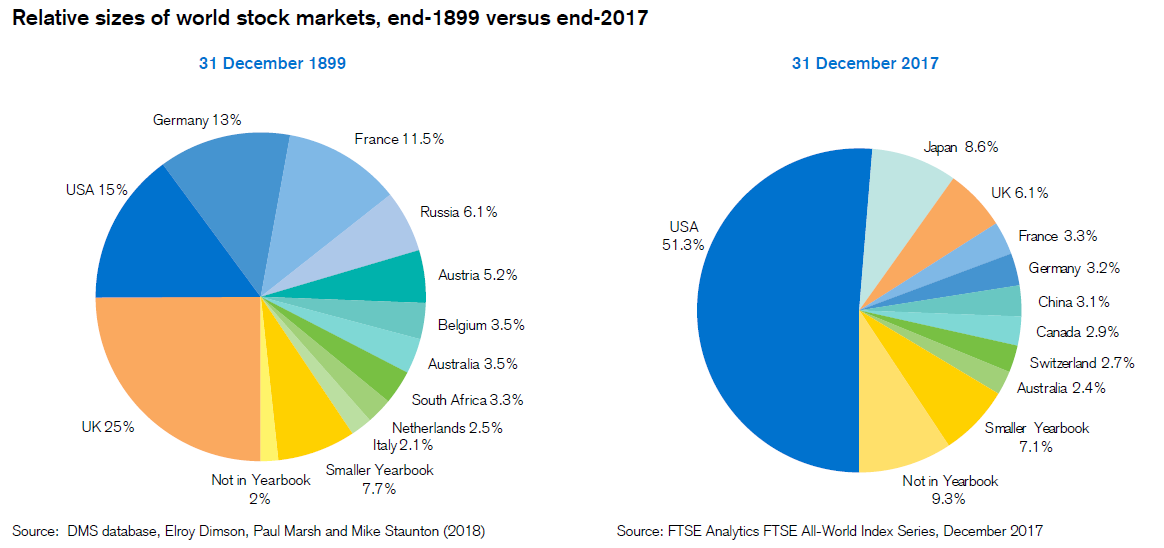

Diversification is a risk management tool. It protects you from the risk of holding a concentrated position, and provides returns from other sources. Investors should also note that they should diversify in an indexed manner – a systematic way of allocating to each country around the world according to the size of the listed companies. This ensures that you are always allocated to up-and-coming growth areas, while automatically selling areas which are becoming less relevant. You won’t need to constantly chase new ideas or themes because they would automatically be included in your portfolio.

The chart below shows how the world market has changed over these past 100+ years. In 1900, Asia did not even feature, and the idea of emerging markets had yet to emerge. UK was the dominant country in the index. By the end of 2017, you can see how countries like China had edged in and America had come to form over half of the global stock market.

It is natural for many people to feel more comfortable putting all their money into Singapore assets due to familiarity and a host of other reasons. But you would do better both in terms of risk management and investment returns – just by diversifying your investments geographically, and in a proper manner. You can love your country, but you also need to be wise about your investments!

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.