Is the stock market broken?

13 December 2019

“Blaming speculators as a response to financial crisis goes back at least to the Greeks. It’s almost always the wrong response.”

—Lawrence Summers

In recent years, the financial media has raised much alarm over how the increased popularity of index funds (such as Exchange Traded Funds (ETFs) and Asset Class funds) have been distorting market prices. The argument is that, with more and more investors “blindly” buying an index’s underlying holdings, sufficient price discovery may not be happening in the market and this could affect market prices.

Headlines such as “Are We Headed For A Passive Index Meltdown?“, “The Big Short’s Michael Burry Explains Why Index Funds Are Like Subprime CDOs“, and “Do Passive Investors Move Markets? They Can” have only heightened concerns among investors that markets might no longer be functioning properly.

But are these fears justified?

In this article, we’ll delve into what the evidence says. The short answer is that market data suggests that markets continue to function normally despite the rise of index funds.

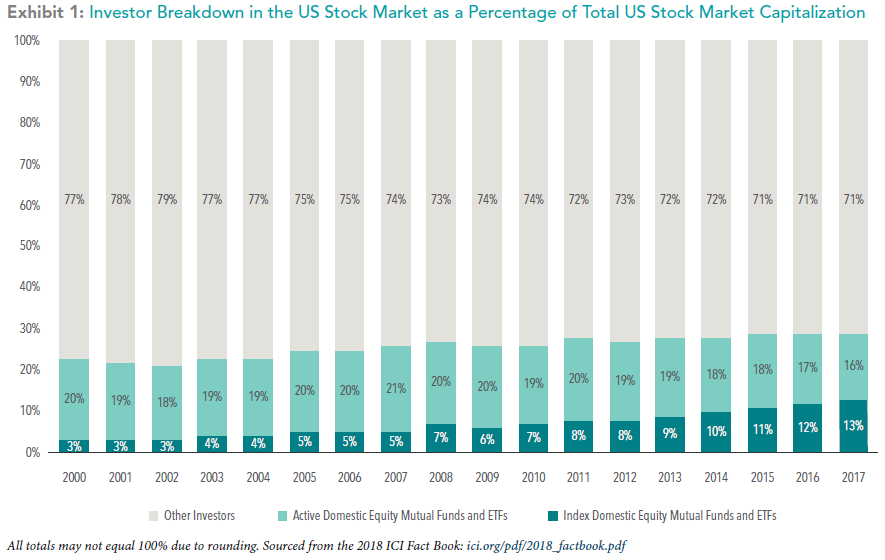

Now, for the long answer. Firstly, despite the increased popularity of indexing, index fund investors still make up a relatively small percentage of overall investors. Data from the Investment Company Institute shows that only around 35% of total net assets (Dec 2017) in the US stock market were held by index funds, compared to 15% at the end of 2007. The majority of total fund assets (65%) were still actively managed. In Exhibit 1 below, you can likewise see that index mutual funds and ETFs comprised only 13% of total US stock market capitalization in 2017.

So, the claim that passive funds are taking over the market does not seem to hold water. The majority of assets are still being frequently bought and sold on an active basis, and not bought and held by long-term investors.

Furthermore, many investors actually actively trade their index investments based on short-term expectations, needs, circumstances, or other reasons. In fact, several index ETFs regularly rank among the most actively traded securities in the market, and the in/out-flows during market cycles show that investors are also using them for market-timing purposes.

This means that the proportion of index funds in the market does not accurately reflect the proportion of passive investors.

Let’s not forget the many other participants in financial markets, including individual security buyers and sellers. There are actively-managed pension funds, hedge funds and insurance companies, just to name a few. Security prices reflect the views and actions of all these investors, not just those invested in unit trusts and mutual funds.

This topic has attracted so much attention that even Nobel laureate Eugene Fama and Professor Kenneth French delved into this topic in their 2007 paper “Disagreement, Tastes, and Asset Prices“. They argue that market efficiency could break down as more investors turn passive, but it depends on various factors. If informed active investors turn passive, it is true that prices tend to become less efficient. Nonetheless, the effect can be small if there is sufficient competition among the remaining informed active investors. Whereas if misinformed and uninformed active investors (who make prices less efficient) turn passive, the efficiency of prices improves instead. And if this research piece is anything to go by, there are many more misinformed active investors than informed ones.

Market efficiency also depends on the costs of uncovering and evaluating relevant knowable information. If the costs are low, then not much active investing is needed to get efficient prices.

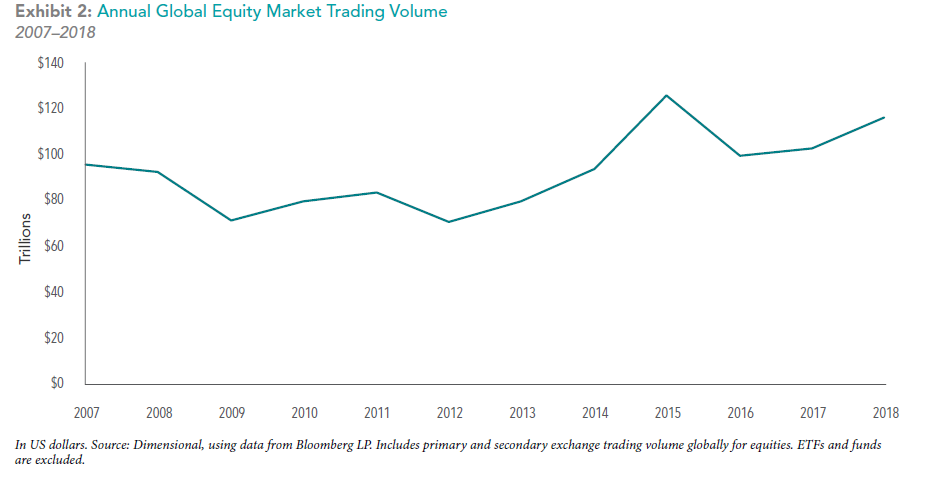

We also see evidence of well-functioning markets in trade volume data. Exhibit 2 shows that despite the rise in index funds, annual equity market trading volumes have remained at similar levels over the past 10 years. This indicates that markets continue to facilitate price discovery at a large scale. In other words, the markets still seem to be behaving normally despite claims that the popularity of index funds are inducing market anomalies.

Meanwhile, there are still other ways through which new information can get incorporated into market prices. For example, companies themselves can impact prices by issuing stock and repurchasing shares. In 2018 alone, there were 1,633 initial public offerings, 3,492 seasoned equity offerings, and 4,148 buybacks around the world.

The derivatives market also play a part. The prices of those financial instruments are linked to the prices of underlying equities and bonds. On an average day in 2018, market participants traded over 1.5 million options contracts and $225 billion worth of equity futures.

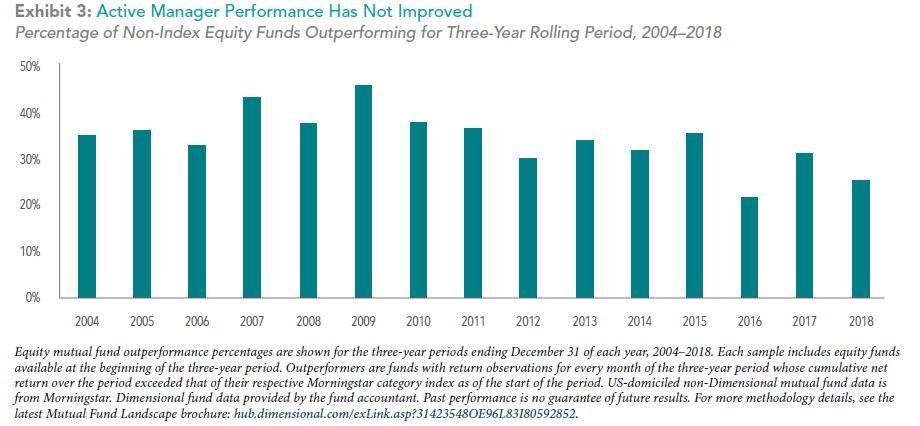

But, for argument’s sake, let’s assume that the fears are valid and indexing is indeed distorting markets and causing “chaos” in market prices. If prices are more opaque now, and more and more companies are wrongly-priced, surely stock pickers, hedge funds and active managers would benefit. Their armies of analysts and computer algorithms would find it much easier to spot any wrongly-priced companies if there are more of them.

Yet Exhibit 3 shows little evidence of this. This chart shows the percentage of active managers that survive and beat their benchmarks over rolling three-year periods. Active management continues to perform poorly. In fact, their rate of success has actually dropped from around an average of 40% to below 30%.

The data continues to support the idea that markets are working, and that we should read beyond these sensational headlines. Naysayers will likely continue to point to indexing as a hidden danger in the market, but it is important that investors keep in mind that index funds still make up just a small percentage of the diverse array of investments.

You can take comfort in knowing that markets are still functioning; willing buyers and willing sellers continue to transact at their desired prices.

At the end of the day, what is most important is whether you are making progress towards the goals you want to achieve. Investing and its many components are just a means to an end. Take comfort that as long as you are utilising the most efficient, cost-effective investment strategy with an appropriate risk/returns ratio, you are already on the right path.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.