Can You Keep Cool Under Pressure?

23 April 2020

“We don’t rise to the level of our expectations, we fall to the level of our training.”

— Archilocus

As the Greek poet Archilocus suggests, our success in many things is often determined not by our skills but our training. The more we have practiced responding to a particular situation, the better we become at handling it.

This is particularly true when it comes to investing – especially now, when markets are turbulent and we’re facing what seems like a never-ending stream of depressing news: depressions, recessions, market sell-offs, deaths, lockdowns, isolation, rumours of wars, and more. Amidst the roller-coaster emotions we’re experiencing in the face of all that stressful news, it helps to return to the fundamentals.

We have prepared and rehearsed many times for this sort of market sell-off. We continually analyse the risk profiles and expected returns in your investments to ensure that everything remains within the desired specifications. We do systematic rebalancing to ensure that your asset allocation does not get overly skewed, risk-wise. We also monitor our proprietary Risk Matrix on a daily basis to see if we should be expecting extreme market anomalies.

All this prepares us for times like these, and we want to also help you be mentally prepared and know what you can reasonably expect to happen with your investments.

From February 20 to March 23 this year, global stocks returned –33%, with daily returns ranging from –12.0% to +9.4%. A drop of nearly 40% in the stock market combined with a spike in volatility can make many investors reconsider their investment approach. (Note that markets have since rebounded 20% from that lowest point on 23 March).

Some might suddenly find stock-picking approaches more alluring. After all, who has not heard the claim that a volatile market is precisely the environment in which many traditional active managers thrive?

But is there any truth to this claim?

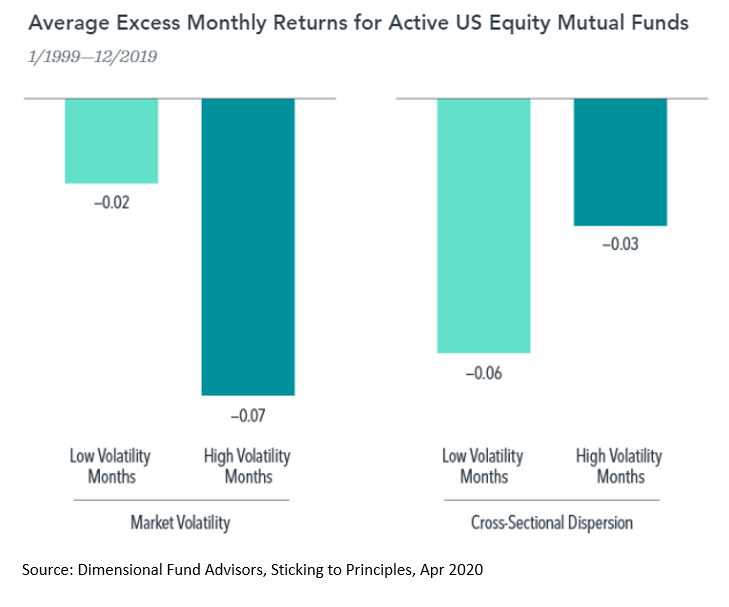

To investigate, we looked at the performance of active US mutual fund managers (which has a very large dataset) over the past two decades. There were two different ways of measuring stock market stress: market volatility (how much stocks rise or fall in a given month) and return dispersion (the range of returns across all US stocks). In each case, active managers underperformed their index benchmarks whether markets were turbulent or not.

Another way some investors might react to a falling market is jumping ship and selling out of stocks. This has been a very common theme over the past month or so. The idea is extremely seductive. Why not sell now to preserve some capital, and then wait it out to buy back into the market at a lower price? Surely that can help avoid further losses.

However, experiences and data show otherwise. Instead of helping you avoid further losses, this type of market timing only reduces your gains over time.

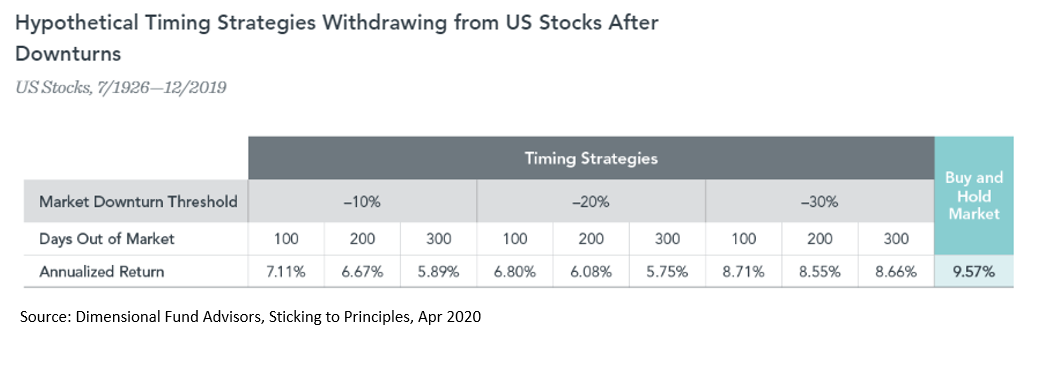

Using extremely long historical data on US stocks, the chart below illustrates this using timing strategies that switch from stocks into US Treasury bills (highest grade bonds) after market downturns of various magnitudes. It then switches back to US stocks after different lengths of time out of the market.

Compared to the market’s long-term annualized return of 9.57%, nearly all of the timing strategies underperform the simple buy-and-hold strategy.

Should these results be surprising? One of the challenges with trying to outguess markets is the unpredictable nature of outcomes. For example, how many pundits would have expected the equity market in China – which was ground zero for the COVID-19 outbreak – to outpace global equities by over 10% year to date (as of March 31)?

You could argue that you are likely to buy in sooner than 100, 200 or 300 days after you sell out. You could also argue that you have a system that could help you get in at the best price possible.

Unfortunately, the reality is likely to be much different. As the news and data get worse each day, many investors get increasingly nervous and find it difficult to pull the trigger to get back in. They tell themselves that they will invest when “things get clearer”; but by the time things get clearer, it is already too late.

As we wrote last week, investing only after the reported data gets better means missing out on an initial +20% rally from the bottom. Why? Because markets are forward looking. The price you see in future cash flows are way ahead of lagging economic data and newsflows.

Nobel laureate William Sharpe’s 1975 research paper “Likely Gains from Market Timing” also showed that such approaches are unlikely to beat a buy-and-hold approach. Why? Because every decision you make (buy and sell) would need a greater than 70% chance of accuracy. Anything less means that your buy and sell decision would be worse than a coin toss, because the chances of accurately buying and selling would be less than 70% of 70%, which comes to less than 49% (0.7 x 0.7).

Financial downturns are unpleasant for everyone. Still, you can reduce the impact by keeping cool and adhering to core principles. Diversify broadly, and rebalance to maintain a consistent asset allocation. These actions are substantiated with a long history of research, and are what we have already been doing for your portfolios.

Don’t give in to the allure of stock picking or market timing, no matter how appealing that may seem in this time. It will only harm you, and ultimately impair your ability to achieve your investment goals.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.