Uncertainty and the Perfect Investing Strategy

30 July 2020

Heisenberg’s uncertainty principle in quantum mechanics states that there is a limit to how precisely you can measure certain pairs of variables. For example, the more precisely you can determine a particle’s position, the less precisely you can determine its momentum, and vice versa. This uncertainty is an inherent characteristic of wave-like systems. No matter how hard you try, you can never know everything.

The same uncertainty is innate to investing. We invest in companies not knowing if they will succeed or fail, or even what their future cash-flow might be. However, it is taking on that very uncertainty (and its associated risk) that gets us rewarded with a return.

This year, the market turbulence around the COVID-19 pandemic was a good example of such uncertainty. Nobody foresaw how markets plunged into one of the fastest sell-offs – a “waterfall decline” – in history. Only two months prior in January 2020, every big bank and broker had been forecasting a rosy year ahead for companies.

The sudden turnaround then took everyone by surprise. The bear market lasted just 40 days, making it the shortest bear market since 1900. It then made history yet again by leading to the strongest post-waterfall rally on record. Investors once more fell over themselves to get back into the market, locking in their losses all to end up right back where they started. In fact, there were many who were left out of the current recovery, as they held on to cash expecting further turmoil ahead.

This happens over and over again in investing. It’s no surprise that many investors fail to achieve decent returns. Not only does the continual flip-flopping often involve buying high and selling low, but investors also incur high transaction costs from every trade they make.

Investors who are already in the market have a natural desire to pre-empt uncertainty or respond to it. Analysing and timing the market can help you feel that the market is predictable and you are in control.

The financial media only feeds that desire. The industry’s trove of experts are always eager to offer their very neat theories on market behaviour. Central bank policies, terrorism, earnings reports, crazy politicians, financial regulation and even spurious indicators like planetary movements or NFL Super Bowl winners are all fair game when it comes to explaining why the market is going up, down or nowhere at all.

Yet, while they might sometimes get it right, the opposite is far more likely.

Simple studies and more detailed academic research into well-known market gurus show that even the best of them do not meet the required level of accuracy to beat a simplistic buy-and-hold diversified strategy. Nobel Laureate William Sharpe’s research into the arithmetic of active management determined that rate to be 74%. Out of 68 forecasters, the best had an accuracy of 68%. The average accuracy was a measly 47.4%.

You may be surprised to know that there actually is a perfect market timing strategy that would capture all the gains and none of the losses. Nobel laureate Robert Merton’s work on market timing included an example of such a strategy.

First, you buy a share of the stock market. Next, you buy a one-month put option. This means that the person selling you the put option agrees to buy back that share in one month at a set price. So if the market price falls below that set price, you can then sell it back to them at a better price than you would get from the market. If the market price rises above the set price, you can then choose to ignore the put option and reap the gains directly from the market.

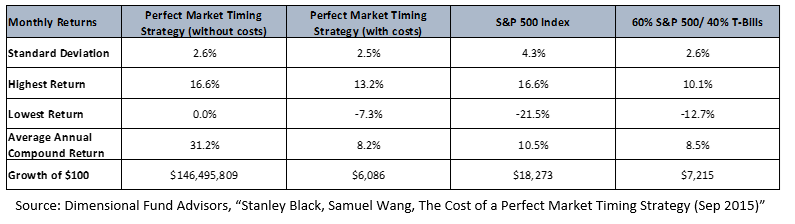

This strategy has a remarkable track record. Its annual returns of over 31% would have grown $100 to over $146M over 50 years! (The period of study was from Oct 1962 to Dec 2014).

Unfortunately, that is only the case in theory. The reality is that there are high costs involved in buying put options. Markets are efficient and incorporate all the news, research and views of the millions of traders and investors. The price of the put set by the efficient market is thus always high enough that it arbitrages away all the advantages of this perfect timing strategy. The final market return with costs then becomes similar to what you would get from a 60% equity and 40% bond strategy. Note that the returns are also far inferior to a 100% equity strategy, although the volatility is lower:

So, if there’s no perfect real world strategy to move in and out of the markets, what can you do? Here are some pointers:

1. You Don’t Need To Be 100% In or 100% Out

Many investors visualise being either 100% invested in either stocks or cash. However, a portfolio with 70% equities and 30% bonds, or 50% equities and 50% bonds may be more suitable to your financial goal, and there is no need to take on additional risk.

Working with a fiduciary goals-based adviser will help you figure out which strategic allocation would be best for you in terms of the risk you can take and the return you need. Combine this with periodic, disciplined rebalancing – where assets are constantly shifted from better-performing asset classes to less favoured ones – for the best long-term chance of success.

2. Lock In Your Gains

If you are on track to meet your goals, there is nothing wrong with enjoying the returns you have already made by adjusting your asset allocation slightly or even trimming some profits off your portfolio.

After a period of good returns, you could put those gains into short-term fixed income or cash-like deposits for safety and spending. The prospect theory says the pain of loss far outweighs the joy of gains, and this way, you won’t risk being overly hurt if your investments get hit by a market correction.

3. Average In

If you’re afraid to invest everything in one lump sum, split it up into smaller amounts and average into the market to spread your risk. Lump sum investing may bring better returns than dollar cost averaging, but when you take into account the emotional stress of deciding when and how to commit that vast amount of money, lump sum investing may not be ideal.

Professor Kenneth French notes that people feel greater regret from things they did rather than did not do. In line with the prospect theory above, most people would find it worse to invest only to lose money, rather than not invest and miss out on an equal amount of returns. Dollar-cost averaging helps to soften that potential loss and make it easier to take action.

Uncertainty is ultimately part and parcel of investing. There’s no secret formula that can tell you the right time to enter or leave the market, or what assets would perform best or worst. Even the most seemingly-logical bets don’t always turn out the way they are supposed to, as this article on the Trump trade shows.

So, if you’re stuck because of all the uncertainty, don’t worry. Most people who say they know where markets are going will turn out to be wrong. There are better factors to base your investment decisions on, such as what you can afford to invest and how much you can afford to lose.

Hence, there is much wisdom in focusing only on those things you can control in the present. The future will always be uncertain.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.