Should you be buying gold?

14 August 2020

“This is gold, Mr. Bond. All my life I’ve been in love with its color… its brilliance, its divine heaviness.”

— Auric Goldfinger

Fans of Ian Fleming’s 007 may recognise the quote from Goldfinger, the 1964 James Bond movie starring Sean Connery. In the movie, the aptly-named villain Goldfinger was the biggest gold collector in the world.

The surge of gold prices in 2020 has also created many mini-Goldfingers. Investors have been jumping onto the bandwagon of buying and hoarding gold, spurred on by financial strategists and “gold bugs” espousing the many benefits of gold. From acting as inflation hedges from central bank money printing to their alleged stability amidst COVID-19 uncertainty, gold seems to be the place to be right now.

But is this true? And what should you do if you have been dreaming of getting your hands on some of that shiny metal?

Firstly, know that gold is intrinsically worthless. Yes, you read that right! Outside of minor practical uses in overpriced audio cables and replacement teeth, gold only has value in human society because we give it that value. We like how it looks. It makes us feel rich. We’re drawn in by its seeming promises of stability, free from the whims of the market.

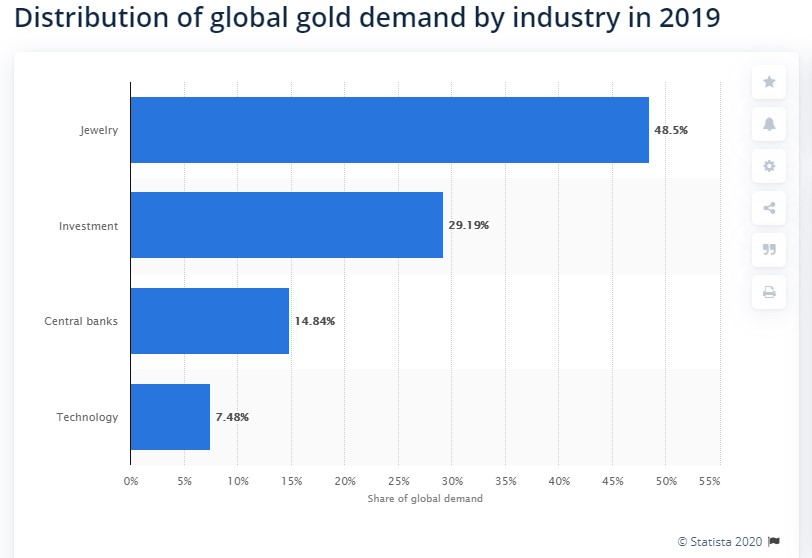

This explains why over 80% of annual gold demand is for jewellery and investment purposes, rather than industrial use:

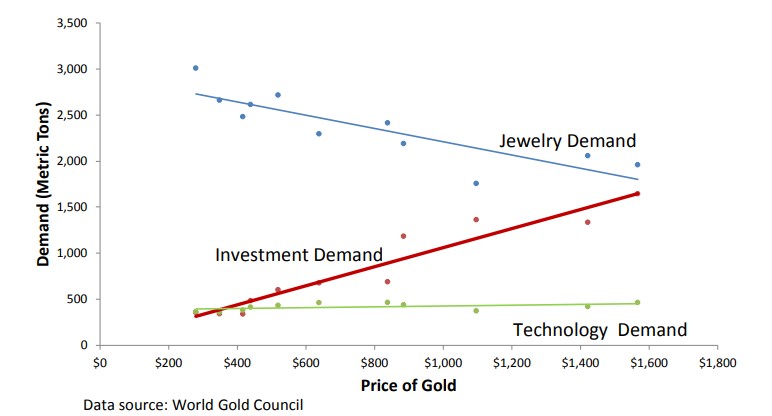

You may be surprised to see that investment makes up only 30% of gold usage, given that it is actually the primary reason gold costs so much. As the chart below shows, demand for gold jewellery is high when gold prices are low, and it drops off as the price increases. In contrast, investment demand actually rises alongside the price of gold.

This seems completely counter-intuitive. Supporters could argue that gold is a Giffen good, but a better and more simpler explanation is that investors’ behavioural biases lead them to chase gold as the price goes up and flee when the price collapses. In other words, it’s very much like the mistake investors make with stocks. Both cases violate the “buy low and sell high” adage.

Current views on gold actually diverge quite a bit. The Oracle of Omaha, Warren Buffet, has often expressed his disdain for gold. He has compared it to the infamous tulip bubble, and in 2019 he showed how an investment in gold returned less than 1% of the return from diversified stocks.

On the other hand, hedge fund king Ray Dalio has long argued for the safety of gold. He foresees a paradigm shift where currencies will hold decreasing value due to central bank policies, and urges investors to put their money in gold.

Such views from gold supporters stem from several reasonable-sounding arguments:

- Gold as a safe haven asset

- Gold as an inflation and currency hedge

- Gold as a driver of returns

Let’s take a deeper look at those claims to see if there is any truth to them.

Claim 1: Gold as a safe haven asset

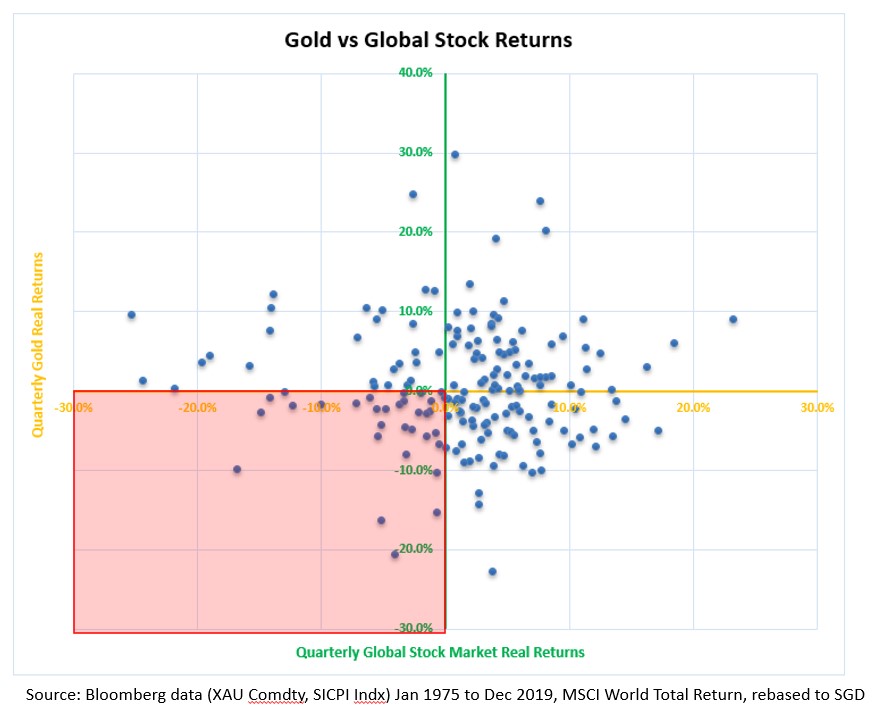

For gold to qualify as a safe haven asset, it would need to negatively correlate to the stock market. Basically, it would have to increase in value when stocks are losing money, and vice versa.

However, when we look at the price data for gold vs global stocks, we see no such negative correlation. In fact, as highlighted in the red quadrant, there have been many occasions when gold lost money at the same time when stocks did.

Claim 2: Gold as an inflation and currency hedge

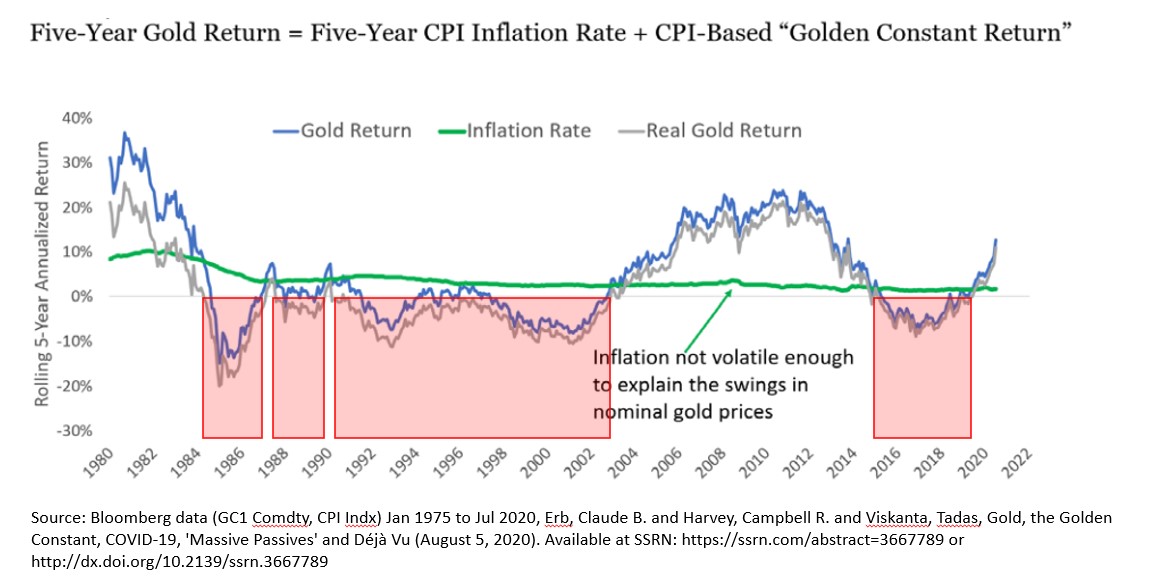

Gold has also been touted as an inflation hedge, but there is no significant statistical data that supports this. The first study on gold, The Golden Constant, was published in 1977. It described a framework to prove gold’s inflation-hedging properties.

However, when you break down the real inflation-adjusted return of gold, we find that the variation of that return was almost entirely caused by changes in the actual price of gold. Inflation itself had no noticeable effect, as the chart below shows. What is more important is how gold often had a negative performance that lasted multiple years.

As for gold being a currency hedge, many investors believe that its return should offset expected declines in the value of their own currency. In other words, if their country is printing money with abandon, it would naturally affect the value of paper money, while the value of gold would remain untouched.

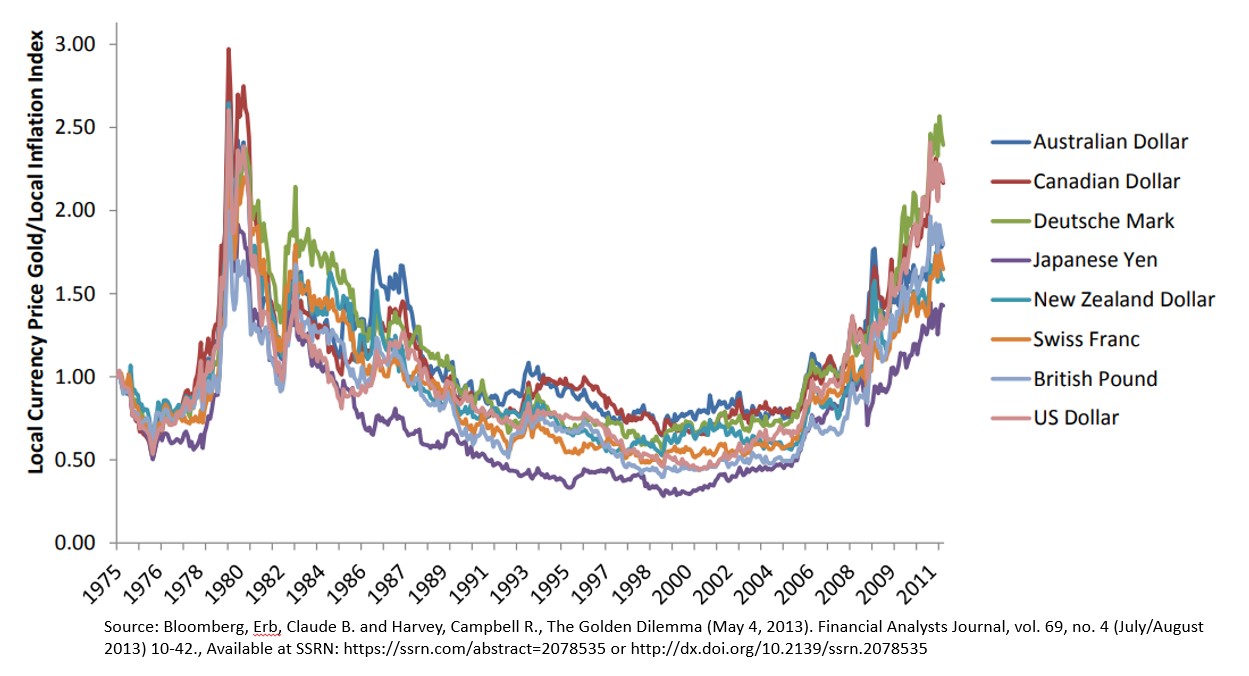

This is the same argument often bandied about by those who trade in cryptocurrencies. However, the chart below tracking data from 1975 shows how the real price of gold in each of the eight currencies studied moved largely in tandem. It presents no hard evidence of gold being a good currency hedge.

Claim 3: Gold as a driver of returns

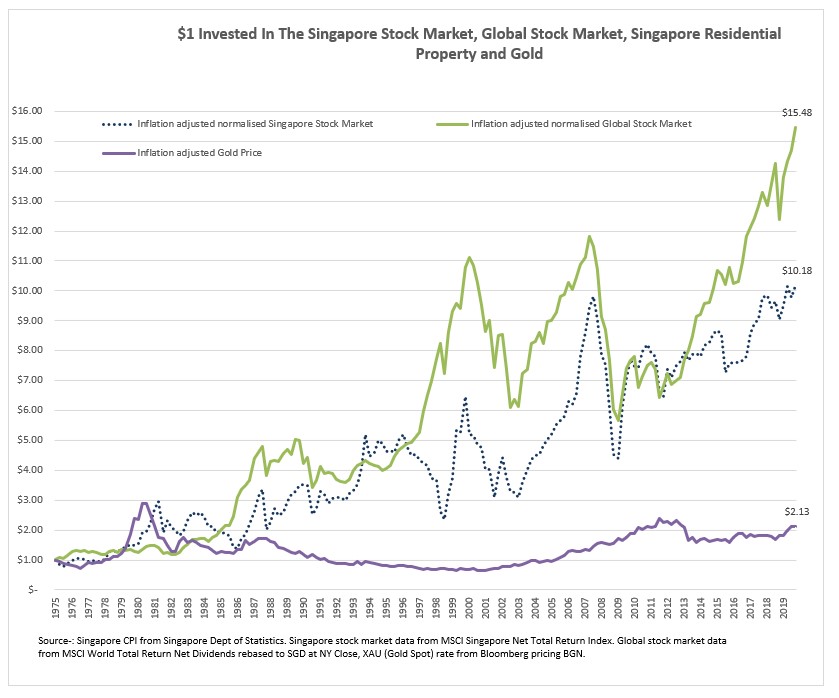

There are also the claims that gold has provided returns far above that of other traditional asset classes. Investors who say so are likely cherry-picking data from specific time periods. If you look at $1 invested in the global stock market, Singapore stock market and gold (all inflation-adjusted and rebased to SGD) from 1975, you’ll see that while gold would have doubled your money after 45 years, stock markets would have multiplied that $1 by more than 10 to 15 times!

So, given the evidence, why would anyone still want to invest in gold? As the saying goes, beauty is in the eye of the beholder. There are numerous logical reasons to avoid buying gold, as we have shown in this article. Unfortunately, we are prone to acting erroneously based on stories in the news that appeal to our emotions. This is true whether you are for or against buying gold. Some of you may think that gold is only for conspiracy theorists who hoard canned food and stock up their underground bunkers for the apocalypse. Others may feel that gold is our last bastion of hope against a chaotic world with record high debt and a penchant for printing money.

Wherever your stand is, we hope the evidence we have presented here will help you make an informed decision – one based on actual data, not hyped-up stories in the media.

Happy investing, and stay healthy!

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.