Markets at a High – Should You Sell Now?

04 September 2020

“Fish gotta swim, birds gotta fly and analysts and market strategists gotta try predicting what stocks will do every year.”

— Jason Zweig

In case you were unaware, US stocks recently hit a new high – right in the midst of the worsening COVID-19 pandemic. Economic conditions are dire. Businesses are collapsing. Unemployment rates are spiking. How are stock prices soaring?

Not surprisingly, CIOs, financial analysts and the financial media have been scrambling to explain just what happened. Some of the common reasons being bandied about are excess liquidity, stimulus packages and a tech bubble.

Strategists have since started recommending that investors hold cash. They predict a “second bear market” that will follow the resurgence of COVID-19 cases, and advise investors to wait until then to buy back in.

Should you follow their advice? Is there really any basis for adopting such a strategy?

What actually happens after a high?

A common misconception is that market highs are bound to quickly come back down. The term for this is “mean revert”. This likely stems from investors’ experiences with individual company stocks. Many stocks that have hit their highs are unlikely to see those same levels again for a long time. SingTel, Keppel Corp and SIA are some local examples that come to mind.

However, the same isn’t true when you’re holding thousands of stocks in a diversified indexed manner. Even if some of those stocks hit their highs and fall back down, there are always other winners in the stock market that are still doing well, boosting the overall returns of the investment.

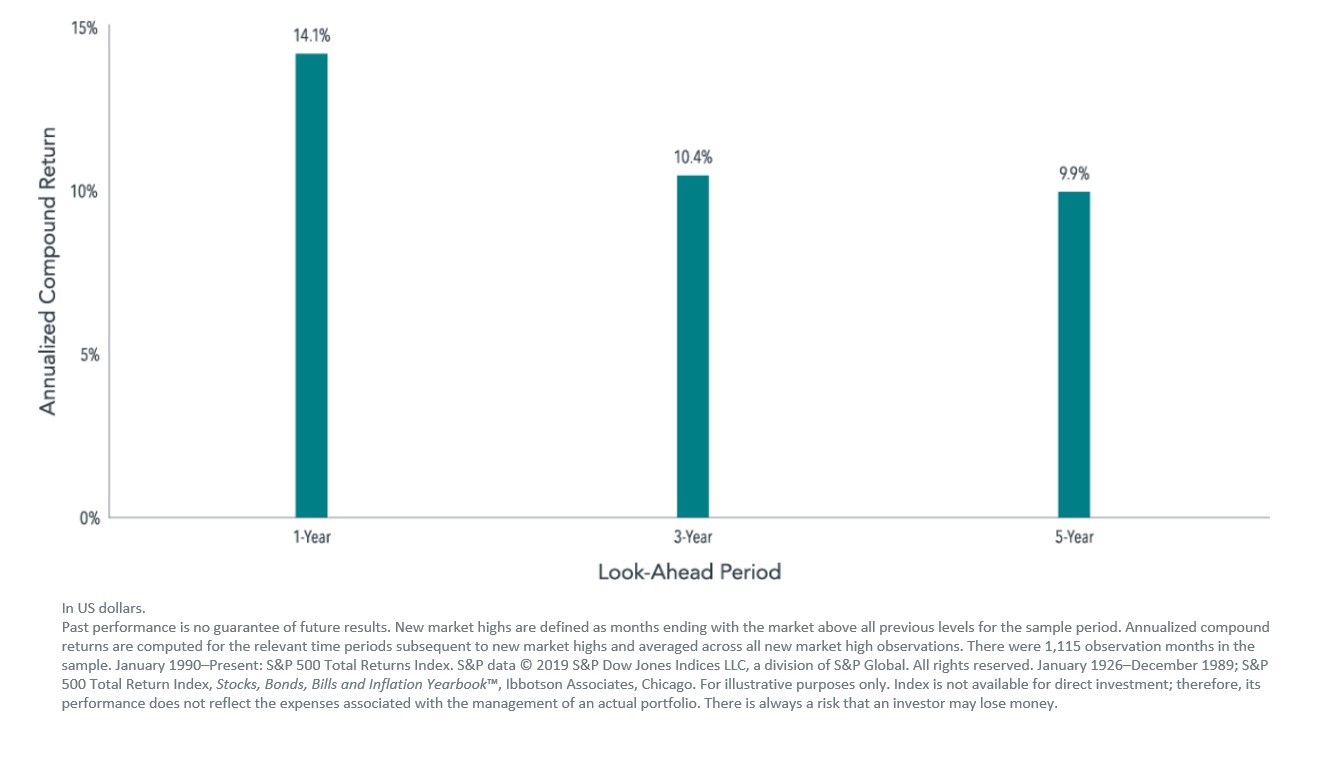

In fact, the data shows that whenever markets hit new highs, they go on to provide decent returns over the short and medium term. And that’s the exact opposite of what many investors believe! Here is a chart showing the 1, 3 and 5 year annualised returns after markets reach a high.

Buying the dip?

One popular investment strategy adopted by many investors is to “buy the dip”. Namely, if you’re afraid to enter the market when prices are high, wait for prices to fall back down before you invest.

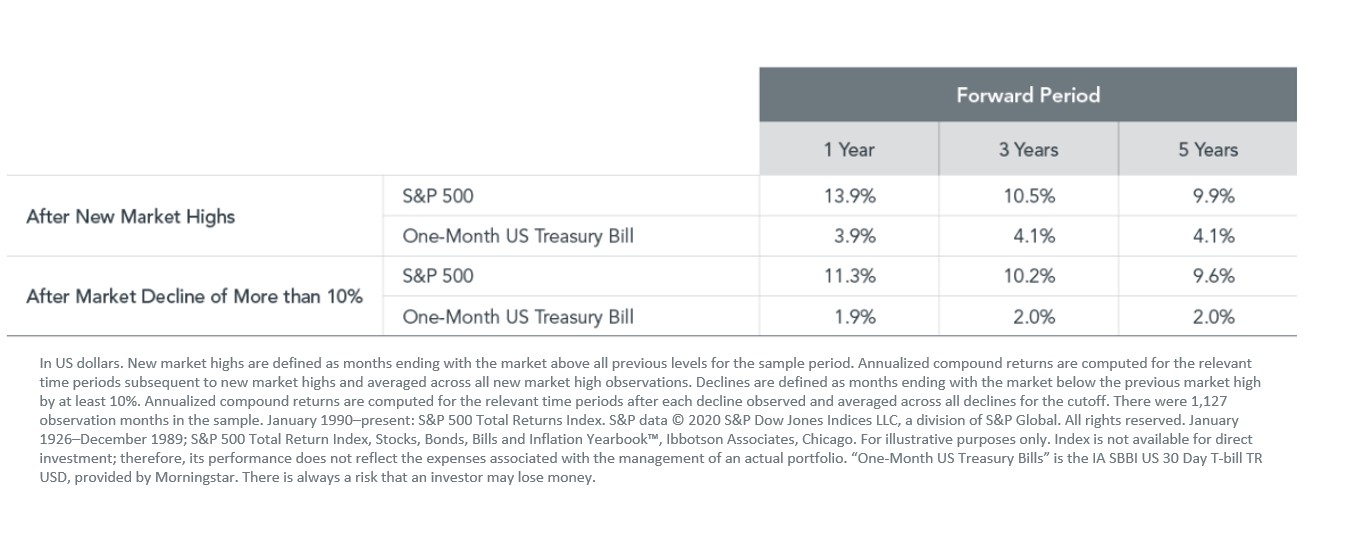

It seems to make sense that buying after prices dip will produce higher returns for equities. Interestingly, however, stock market data going all the way back to 1926 shows the exact opposite is true: returns after a market high are actually higher than after a dip!

How could this be? The likely culprit is momentum.

Nobel laureate Eugene Fama and Ken French documented the effect of momentum, amongst other market anomalies, in a 2008 academic paper. They noted that stocks with low returns over the past year tended to have low returns for the next few months. Similarly, stocks with high past returns tended to have high future returns. This phenomenon could not be explained by valuation theory or pricing models.

What is the Best Way to Invest in This Type of Market?

Research by passive fund giant Vanguard and their competitor Invesco shows that a lump sum investment is the best strategy to gain exposure to the market when you need to. Theory and data both suggest that lump-sum investing is the more efficient approach to building wealth over time.

This means that the best way to invest is to put all your investable funds in at once as soon as you can, regardless of what stage the market is at. In most cases, the more time you’re exposed to the market, the better off you will be.

Nonetheless, you might still be hesitant to put in all your investable funds at once. If markets have recently hit all-time highs, you might wonder if you’ve already missed your chance. You might want to wait for prices to fall before getting into the market, in hopes of catching the next high. Conversely, if stocks have just fallen and news reports suggest more declines might be on the way, you might take that as a warning sign to wait.

Driving the reactions to these two very different scenarios is the same fear: What if I invest today and the price goes down tomorrow?

Fortunately, as we’ve shown in the previous section, that fear is unwarranted. Market highs are more likely to continue rising than falling. Prematurely fleeing the market in fear and panic will only derail your best laid plans.

Instead, dollar-cost averaging could be a reasonable strategy for those who might otherwise opt to stay out of the market altogether. Going gradually into the market is better than not investing at all.

A trusted financial adviser will be able to help you decide which approach is better for you. Lump-sum investing and dollar-cost averaging each have different pros and cons. Understanding your financial goals and circumstances can help you work towards an informed decision.

What is clear is that markets have rewarded investors over time. Whichever method you decide to pursue, the overall aim is the same: develop a proper plan, and stick with it. Abandoning it or changing course half-way – such as during market highs – would only be a sure-fire way of sabotaging your progress towards your financial goals.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.