How do you maximise your money in retirement?

07 October 2020

Volatile markets are a constant source of anxiety for retirees and those nearing retirement. Record low bond yields, expensive dividend yielding stocks and economic uncertainty only add to the stress. If you’re no longer earning a paycheck, how can you ensure that you don’t run out of money?

Back in 1996, financial adviser William Bengen published a paper that mooted a 4% withdrawal rate for retirees to live off their accumulated assets. He posited that this was the optimal withdrawal rate to allow someone to get by comfortably without the fear of their assets prematurely running out.

This “4% rule” became famous and was widely bandied about by financial planners everywhere. However, this promise of portfolio longevity came with certain caveats.

1. High equity allocation

In his study, Bengen noted that the portfolio needed to hold at least 50% in equities but not more than 75%. These stocks had to be diversified and managed in an indexed manner. Any allocation outside of these parameters would cause a drastic decrease in the portfolio’s lifespan.

The problem here is that many investors, let alone retirees, are not equipped to handle the drawdowns of a portfolio with such a high proportion of equities.

2. Regular rebalancing

Bengen’s sample portfolios were rebalanced annually. In theory, there shouldn’t be any problem with that. But imagine being a retiree who’s fully dependent on that amount of money being asked to sell bonds and buy equities as stock prices are collapsing.

During the COVID-19 sell-off in March, many investors froze into inaction, unwilling to add to their equity positions even though it was the right thing to do. We will definitely be facing many more asset price drawdowns in future. Would you be able to stick to the rules?

3. Cost of fees

Bengen’s study did not account for fees. If you have a lot of assets in high-cost hedge funds, structured products or retail unit trusts, those high fees will eat away at your returns and hamper your ability to fulfil the portfolio’s objective.

There has been much debate on the 4% withdrawal rate. Many have described it as unrealistic, given the extremely low bond yields and lofty equity valuations. They highlighted that it was impossible to match historical market returns.

However, we know from scientific research that long-term rates of return are possible even when investing at market peaks or extreme valuations. Doing so just takes longer for the portfolio to right itself. As such, the issue is not your withdrawal rate, but rather how flexible your withdrawal rate can be.

As an example, take two 60 year olds using the 4% withdrawal rate as a guide for their cashflow. At first glance, their situations look the same. Yet one of them needs the full 4% withdrawal from his portfolio just to get by day to day. If there is a spike in inflation or he needs to take less, he won’t be able to pay for all his necessities. In comparison, the other only needs around 2.5% of the 4% drawdown to cover her necessities, and uses the remaining amount for small quality-of-life improvements such as holidays and the occasional fine dining experience. This gives her the flexibility to reduce her withdrawal rate without affecting her basic survival.

Bengen’s study showed that just by reducing the drawdown on the portfolio from 4% to 3%, an investment portfolio could last at least 50 years across all types of market environments – including some of the most severe market drawdowns in history.

The flexibility to reduce your drawdown in response to market conditions can therefore be a lifesaver, ensuring your funds continue to survive as long as you need. Unfortunately, many people do not have the ability nor experience to adjust their plans and budget on the fly.

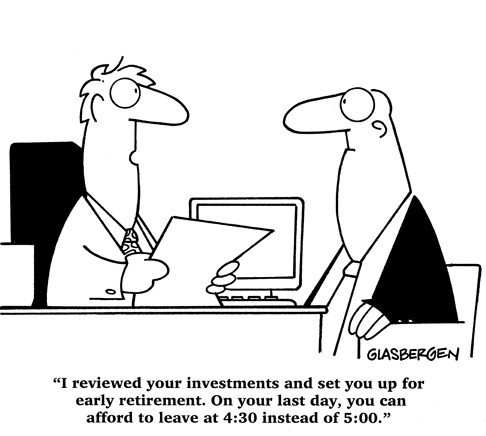

It is therefore best that you make such contingency plans before circumstances force you into bad decisions. If you need help, an experienced financial adviser will be able to guide you through the process. It would be good to schedule regular meetings to review any changes in your personal and financial life, as well as updates on your portfolio and goals to ensure you can remain financially sound.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.