Winter is Coming

24 October 2018

“Winter is coming” was a catchphrase from the hit HBO series Game of Thrones. While it could simply be taken as a suggestion to prepare for upcoming seasonal weather, its use in the show was to propagate an underlying message of constant diligence and preparedness for tough times ahead.

We believe this is also a timely message for bond investors, as there are now signs that the more than 30-year bond bull market is finally turning.

Asset Cycle

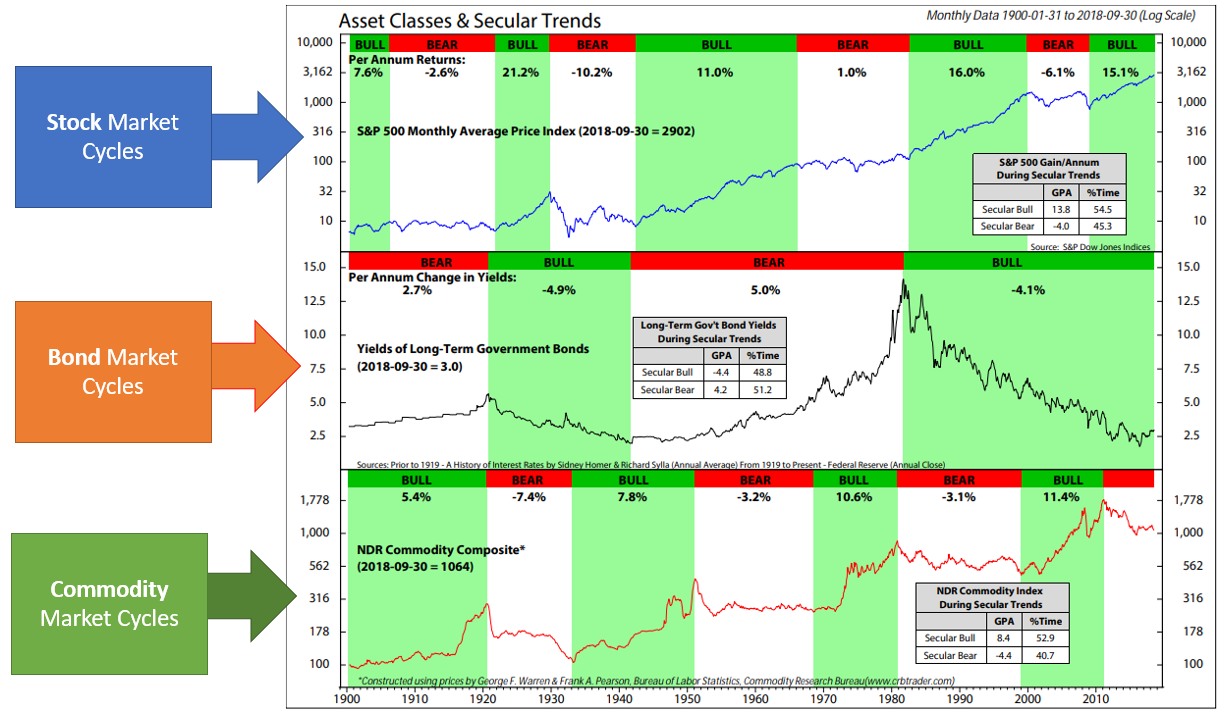

The chart below gives you a helicopter view of the main asset class trends since the 1900s. You will notice that the secular cycles for stocks and commodities are relatively shorter, averaging around 8 years. But the cycles for the bond market are extremely long, and bonds have been in a bull market since 1981 – a fantastic 37-year period when interest rates kept going down and, conversely, bond prices kept going up. When interest rates rise, bond prices go down. Equity investors thus suffer much more volatility, although the pain is mainly short term. Bond investors have a generally much smoother ride but the possible weak periods can stretch for decades.

Yields Rising

The assessment for the bear market for bonds comes not just from looking at these long-term charts. There are many other indicators which which show that we are likely now in a bond bear market cycle. For instance, the long-term downtrend of yields had recently been broken (see chart below). The breakout is significant from a technical basis.

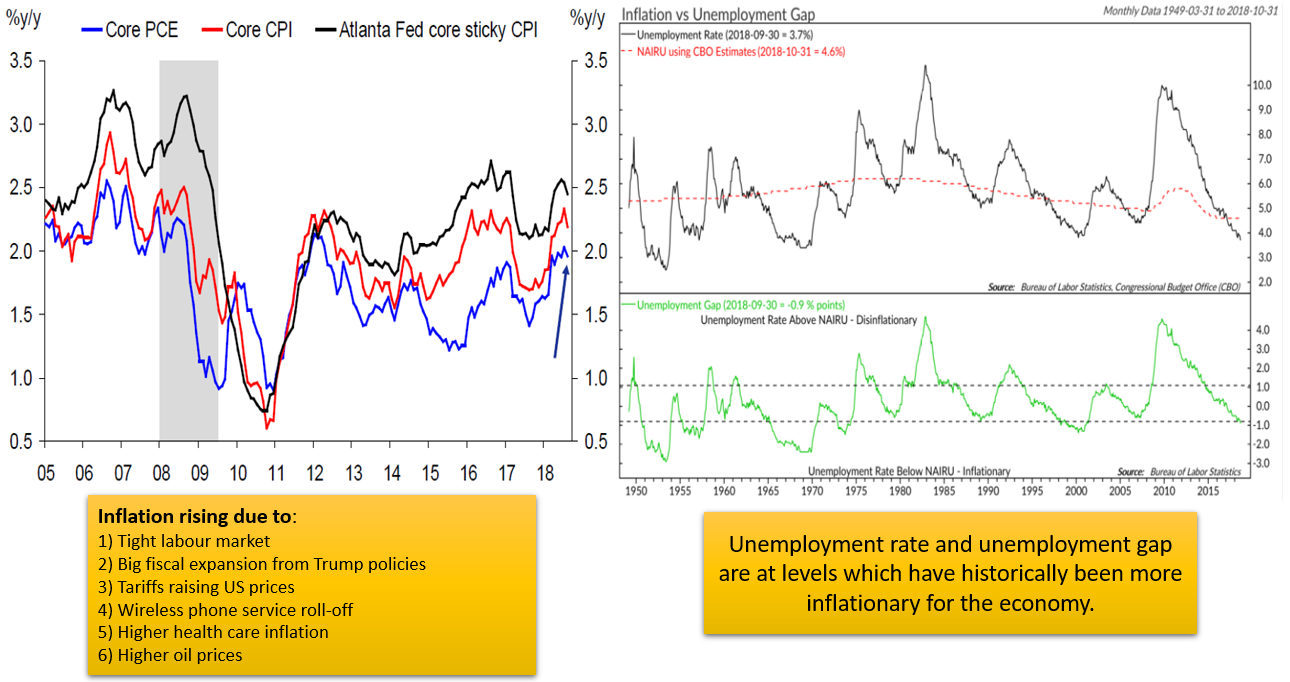

Higher Inflation

Next, there are clear signs of sustained inflation from external (e.g. rising prices, tariffs) and internal factors (e.g. unemployment gap, inflation swaps). Rising inflation is negative for bonds as the majority of bonds are not inflation protected, and therefore suffer during inflationary periods.

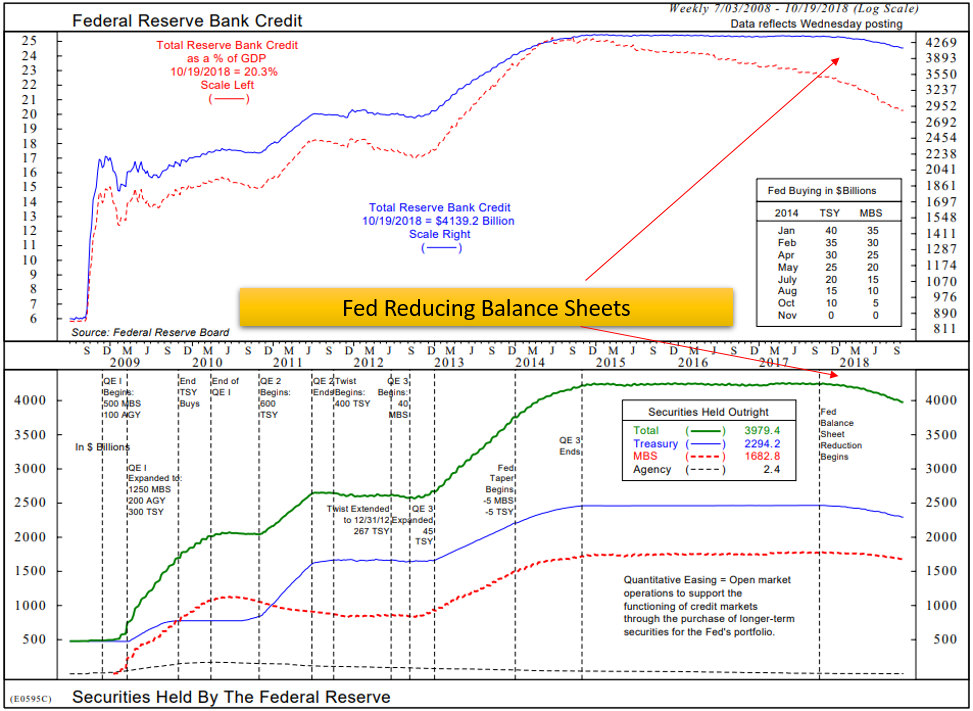

Fed Tapering

The US Federal Reserve, which has been operating its QE program since the financial crisis, has already begun tapering and increasing interest rates at the same time. This action is reducing the number of fixed income securities which they hold outright, contributing to weaker demand for treasuries, and in effect making yields rise across the board.

Bond Losses

Many of the boxes have now been ticked to indicate that we are probably in a bond bear market. For 2018, bond investors have likely been experiencing something they haven’t experienced in a long time – losses. The chart below shows a list of ETFs which track well known bond sectors. The majority of bond prices are negative this year. For the few bond sectors that have flat to positive returns, this is due mainly to forex, i.e. USD strength versus SGD (around 2%), and from the coupons that the bonds pay. From a price change perspective:

- Asian Credit = -3.04%

- Asian High Yield = -4.24%

- US High Yield = -0.49%

- US Dollar Investment Grade Bonds = -1.37%

- US Dollar Long Duration Bonds = -7.67%

- US Dollar Intermediate Duration Bonds = -1.75%

In light of these negative developments, what should an investor do? Sell all the bonds they hold? That may not be the best approach. So, here are some tips to ensure that you are not overly affected by it.

A Diversified Approach

Holding 5 to 10 bonds in a portfolio is not a diversified investment. The number of bond issues in your portfolio should ideally number in the hundreds. This is necessary to ensure that you are not on the wrong side of statistical probabilities. On average, the default rate of credit (both investment grade and high yield) is around 1%. The actual rate fluctuates on an annual basis and becomes worse during economic crises.

You do not want to be holding some of the credits which default, especially during an economic downturn. Holding a diversified and large number of bond issues helps to ensure that your probability remains low. In addition, many bond investors cannot be properly diversified holding just a few names. As investors typically have a home bias, Singapore investors prefer names which they can recognise and are comfortable with. The downside of this approach is that many investors end up holding only a few Singapore companies, sometimes all from the same sector (example: banks like OCBC, DBS, UOB are favourites).

However, in investing, investors should not be exposed to only one economy, let alone all from the same industry. Holding a small portfolio of bonds is also quite risky, as we have written before.

The Reasons for Holding Bonds

Some investors do require allocation to bonds in their portfolio to buffer the volatility from the equities in their portfolio. Others hold bonds to get a stable coupon to fund a liability. As such, the goals and needs of each investor differ. As long as an investor is holding a diversified allocation, they need not worry. High grade (not high-yield) bonds are also anti-correlated to stock market movements, such that when stocks are doing poorly in an crisis, the flight to safety in high quality bonds will counteract (to a certain degree) the fall in equity prices.

Savers May Finally Get Some Reprieve

Compared to a year or two ago, the same quality bond will now offer you a better yield. Savings and deposit rates are also slowly creeping up. For individuals who require high-grade liquidity or have short-term funding needs, the higher rates will benefit them.

At the end of the day, investors have to be aware that every investment asset class carries its own risks. Many people have been lulled into a false sense of security from the very long bond rally, and this was further fuelled by easy monetary policies by central banks since the Great Financial Crisis. Bond investors must be aware that the heady days of high single-digit returns from bonds could be over.

However, there is no need to sell your bonds immediately if you already have a diversified approach, and your financial goals and returns expectations have been properly matched by an independent fiduciary adviser. Bonds still form an important part of your portfolio, but investors should not be expecting them to provide the same degree of returns as they did over the past 30 years.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.