26 February 2016 | Behavioural Finance, Investing

Category: Behavioural Finance

25 February 2016 | Behavioural Finance

Forecasting – Getting You Nowhere Since 1970

3 February 2016 | Behavioural Finance

Attraction to Rising Prices

10 January 2016 | Behavioural Finance

Chasing Hot Themes

26 September 2015 | Behavioural Finance, Investing

Should Investors Sell After a “Correction”?

2 July 2015 | Behavioural Finance

Causal Connections

19 April 2015 | Behavioural Finance

Negativity Dominance

GYC Perspectives

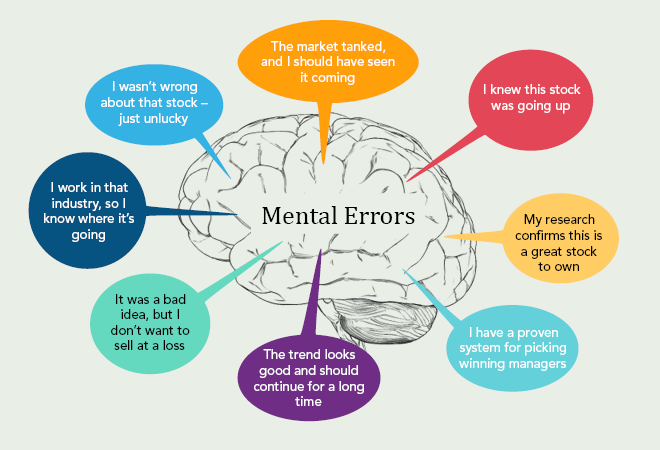

Markets are often irrational. Even among experts, forecasting does not consistently work. We instead believe in Evidence-Based Investing (EBI), which uses decades of empirical data and the greatest ideas in financial science to optimise investment outcomes. No market predictions, no forecasts, no emotions. All those things rely on gut-feel and intuition that cannot be consistently replicated.

Here, we share with you the evidence on why EBI works and why forecasting doesn't, as well as articles on topics such as behavioural finance to help you become better investors. New here? You can start with this introduction to EBI. Happy reading!